34+ Monthly 401k withdrawal calculator

When withdrawing your retirement savings from a 401 you can decide to take a lump-sum distribution take a periodic distribution buy an annuity or rollover the retirement. Your employer needs to offer a 401k plan.

What Is Involved In Financial Planning Quora

This amount doesnt include your pension or social.

. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Please visit our 401K Calculator for more information about 401ks. Ad If you have a 500000 portfolio download your free copy of this guide now.

A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term. And from then on. Ad Use Our Early Withdrawal Calculator Tool To Understand The Potential Impacts.

Amount You Expected to Withdraw This is the budgeted. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. IRA and Roth IRA.

You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. 25Years until you retire age 40 to age 65. The benefits of most of these plans include a tax deduction on any contributions but the downside with all of these is the retirement withdrawals will be taxed as income.

The withdrawal amount translates to a monthly withdrawal amount of or a quarterly withdrawal amount of. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

Or withdrawals may be tax-free. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit. This retirement calculator is for retirement planning.

Expected Retirement Age This is the age at which you plan to retire. We designed the present savings withdrawal calculator to find the answer to all the above questions. This withdrawal rate calculator can be used to estimate monthly and annual income in retirement.

A withdrawal savings calculator that. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. The benefits of most of these plans include a tax deduction on any.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. Expected Retirement Age This is the age at which you plan to retire. Retirement Withdrawal Calculator Terms and Definitions.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. Use this calculator to estimate how much in taxes you could owe if. The calculator requires a total of seven inputs to determine these values.

Understand What is RMD and Why You Should Care About It. Or of your investments. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA.

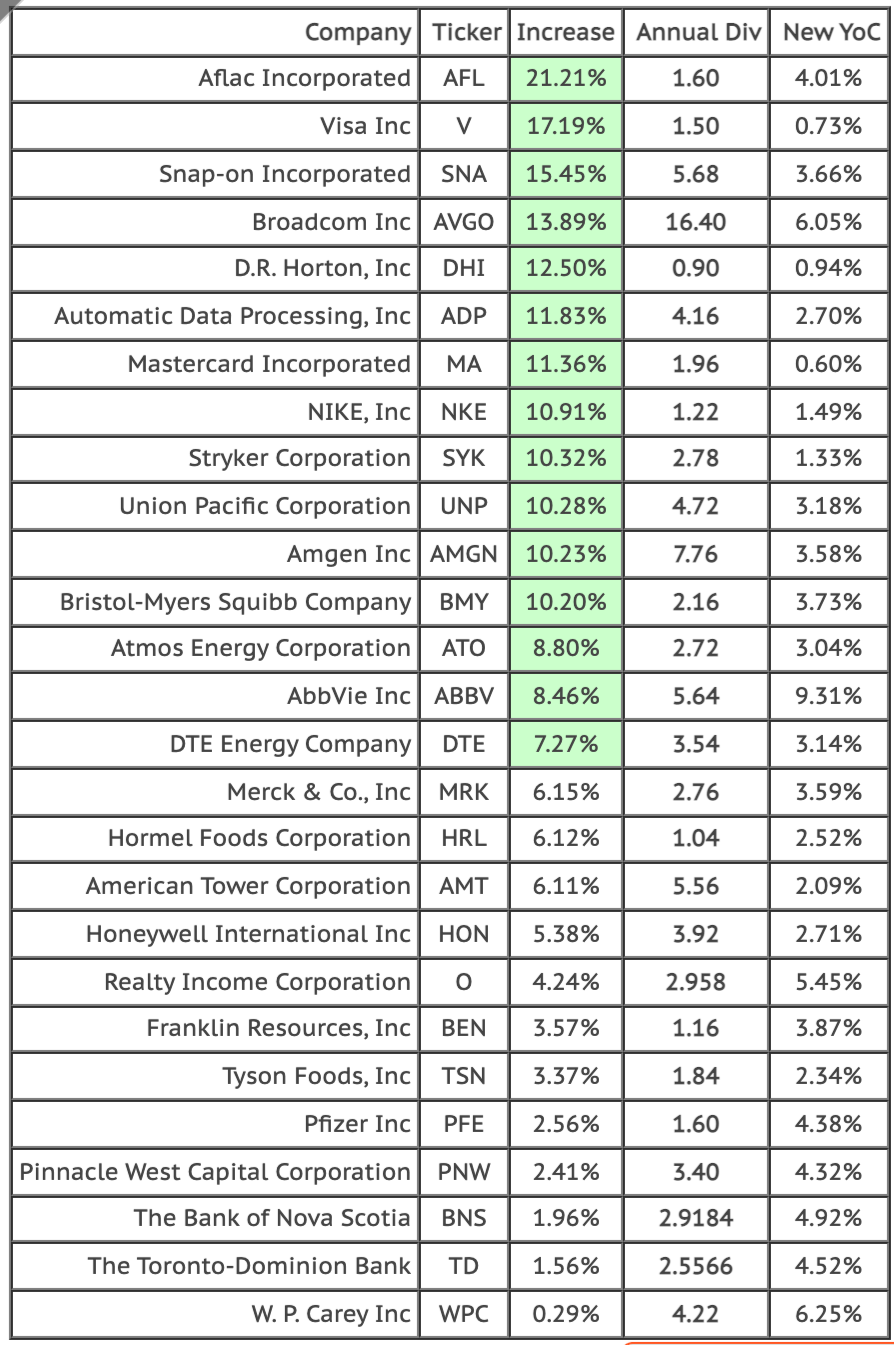

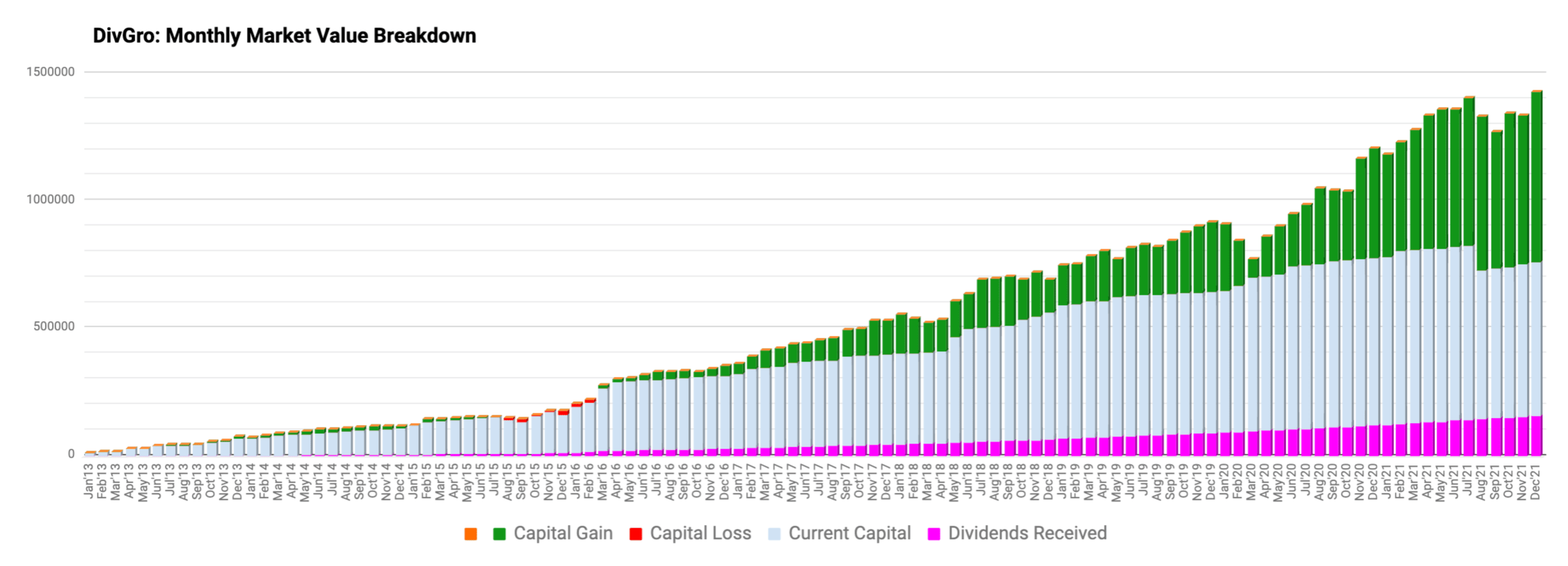

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

15 Best Investment Apps For Beginners In 2022 Updated Ranks

2

My Age Is 34 My Monthly Take Home Is 60k What Will Be The Best Financial Planning For Me Quora

2

Retirement Calculator Spreadsheet Budget Template Retirement Calculator Simple Budget Template

15 Best Investment Apps For Beginners In 2022 Updated Ranks

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

What Is Personal Financial Planning How Do I Do Personal Financial Planning Quora

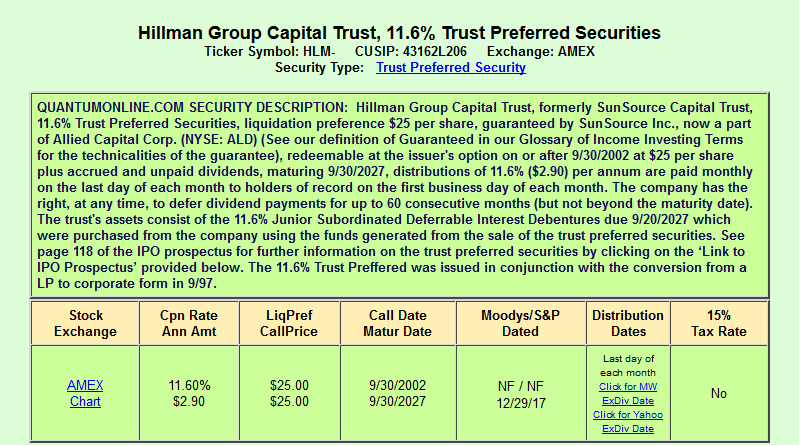

The Hillman Companies Smells Like Refinancing Nysemkt Hlm P Seeking Alpha

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Is The 7prosper Annual Financial Plan Worth It Quora

What Is Personal Financial Planning How Do I Do Personal Financial Planning Quora

What Is A Financial Plan Quora

What Is A Financial Plan Quora

Quarterly Review Of Divgro Q4 2021 Seeking Alpha